Zapmap has published the results of its eighth annual EV charging survey, the most established and comprehensive of its kind in the UK.

Conducted during September-October 2025, the annual survey offers an unparalleled analysis of UK EV driver behaviour and sentiment, providing the industry with insights into how EV drivers are using the variety of different charging options that the UK's public network provides.

Responses show that satisfaction with the public charging network continues to improve, while also highlighting areas which require industry focus.

Key findings from the 2025 survey:

Vast majority of EV drivers love driving electric

Overall EV driver satisfaction with electric vehicles remains high, at 88% compared to 87% in 2024.

While the cost of driving electric has been in the spotlight over the past 12 months, there has been an increase in the proportion of drivers who say their EV is more cost effective than ICE (83% compared to 78% last year).

72% credit environmental benefits as a key reason for owning an EV (similar to 2024) while 70% state better performance (up from 65% in last year’s survey). The number of EV drivers who want to switch back to internal combustion engine (ICE) vehicles remains low and static at 3%.

Satisfaction with public charging infrastructure continues to grow

This year’s average rating for satisfaction with the public charging experience is 69 out of 100 — an increase from last year’s responses of 5 points. 60% of respondents feel that public charging has improved over the past year (similar to 2024 responses). This increase in satisfaction may be driven by the growing number of charge points available (more than 13,000 additional devices compared to the end of October 2024), or improving reliability, with scores in our networks rankings generally increasing for this area.

Access to home charging does not influence confidence in using public charging

Notably, access to a home charger makes little difference to EV driver confidence in using the public network, which stands at around 73-74% for both groups. We will continue to track this metric in future surveys.

23% of survey respondents do not have access to home charging, a slightly higher percentage than last year’s figure of 21%, suggesting more drivers without a driveway are making the switch to electric, supported by the growing availability of near-home charging options (albeit the sample leans towards users of the public charging network).

Key segment of EV drivers using public network intensely at key moments, rather than consistently through the year

The proportion of EV drivers using the public network less that once a month remains at 49%, but more detailed questions this year reveal that more than half of these (28% ) are only using the public network during specific periods, such as summer holidays or the festive season, rather than steadily through the year, suggesting that they so may have less familiarity with usage or network idiosyncrasies.

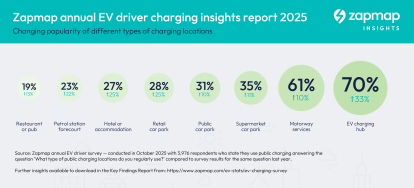

Charging hubs have surpassed motorway service areas as most popular place to charge

Use of EV charging hubs has been increasing steadily over the past few years, according to responses to our survey, with the number of drivers using them more than doubling over the past three years from 34% in 2022 to 70% this year. Hubs are now the most popular location for EV drivers to charge, overtaking motorway service areas, which have led in previous surveys. Since last year’s survey, in October 2025, an additional 219 hubs have been added to the Zapmap database, with 924 now distributed throughout the UK.

The most used networks by our survey respondents over the past six months are GRIDSERVE Electric Highway and Instavolt, with both being used by 53% of respondents. Our recent rankings of the best EV charging networks, derived from survey responses, awarded both these charge point operators the accolade of ‘Zapmap EV driver recommended‘ networks based on driver satisfaction across a range of metrics.

Our ongoing tracking of charging location data shows that hotel / accommodation charging provision has grown significantly over the course of 2025 (by nearly 36%). This is reflected in a steady increase in usage of this type of charging location (now at 28% of respondents) potentially signposting the wisdom of accommodation providers thinking about EV charging facilities as a means of meeting customer needs.

Jade Edwards, Head of Insights at Zapmap, commented:

“In the rapidly evolving public charging landscape, Zapmap’s EV driver survey provides valuable insights into their changing needs, providing actionable guidance for industry to meet and anticipate future demand.

“Comparing driver sentiment with more qualitative data on the size and shape of the charging infrastructure highlights how the industry is keeping pace with demand across different use cases. With over 1.7 million BEVs now on our roads, it’s good to see that satisfaction levels continue to rise. To ensure this trajectory continues as EVs move into the mainstream, we need to ensure that public and private sectors work in step to ensure equitable and affordable access to public charging.”

Dora Clarke, Head of Brand & External Affairs at Osprey, said:

“The full findings of Zapmap’s Annual Driver Survey give us important extra detail on how drivers choose and use charge points in the real world, informing our location strategy, site development and design, and customer experience improvements over time.”

Now in its eighth year, the survey attracted 3,976 respondents, all of whom drive fully-electric vehicles (BEV-only, PHEVS excluded). The survey covers a wide range of topics, including the proportion of EV drivers with access to home charging, the most popular charging locations across the UK, and the key factors influencing where and how drivers choose to charge their vehicles.

A copy of the key findings of the report can be found at: www.zapmap.com/ev-stats/ev-charging-survey

Methodology

The annual survey is conducted by Zapmap to better understand the charging needs of EV drivers, the findings being used to improve Zapmap and EV charging facilities in the UK. The survey is conducted online with respondents invited from Zapmap’s 75,000+ opt-in survey panel – retail vouchers (draw) are offered as an incentive. The full survey takes 15-20 minutes to complete and is intended for EV owners and users only.

Owners of plug-in hybrid vehicles (PHEV) were specifically excluded from the survey this year.

The EV Charging Survey 2025 was conducted during September and October 2025. Questions focused on three key areas: EV ownership, Charging at home, Charging in public.

Question types included: Single choice, Multiple choice, Open text, 5-point Likert scale type responses.

The final results included 3,976 respondents who drive a fully electric vehicle (EV).