For the EV industry, 2025 started with a consultation on the ZEV mandate and ends with a question mark over if and how the UK government will respond to the EU’s revised 2035 zero-emission new car sales target — from 100% to 90%.

In spite of some uncertainties, 2025 has brought many positives: the EV market is on track to reach the ZEV mandate target for this year of 28% target after OEM flexibilities while the Electric Car Grant (ECG) scheme, launched in July, now covers 43 different models that meet sustainability and affordability criteria, offering up to £3,750 towards their list price. The impact of the ZEV mandate can be seen in the volume of new EV registrations, with more than 426,000 new EVs sold to date; a significant uplift on 2024 registrations (381,970) and bringing the overall EV car parc to 1.75m. This year has also seen growth in the used car market, as BEVs from three years ago returned to sale: 4% of all used cars sold in Q3 2025 were BEVs, [Source: SMMT] reflecting higher consumer confidence in EVs, battery life and public charging.

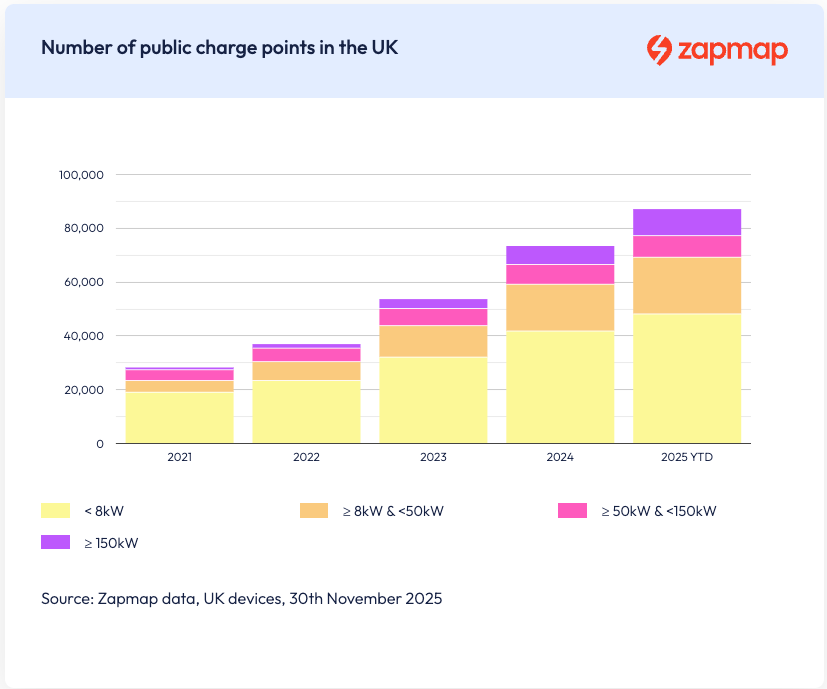

In August the charging infrastructure passed the milestone of 85,000 charge points, spread across en-route, destination and near home charging use cases, a huge achievement for an industry that barely existed a decade ago. Zapmap utilisation data shows that charging sessions have climbed steadily through the year and we’re set to surpass four million monthly sessions early in 2026.

While network growth throughout this year has been lower than we saw in 2024, high-powered charging opportunities for longer journeys continue to proliferate, and we’re seeing strong regional growth in areas outside London and the South-East, with Wales being the area of highest regional growth this year, albeit from a low base. In addition we’ve seen increasing numbers of LEVI tenders being awarded each month, which will provide much needed near-home charging for those without off-street parking.

So, a sense then that we are seeing EVs transition into the mainstream and the industry moving towards increased maturity. Will the EU’s recent shift of target for zero emission car sales lead to changes in the UK in the form of a diluted ZEV mandate or revised deadline, or will policy makers seize the opportunity to consolidate the country’s leadership position?

The right charger in the right place

“If 2024 was about across-the-board growth” observes Jade Edwards, Head of Insights at Zapmap, “this year has been marked by targeted areas of focus with both public and private sectors giving thought to shaping the EV market to best meet driver needs.”

Ultra-rapid devices (150kW+), the fastest charge points designed to support EV drivers on longer journeys, continued to show the highest growth. As at the end of November there are nearly 9,759 ultra-rapid charge points, representing over 46% year-on-year growth.

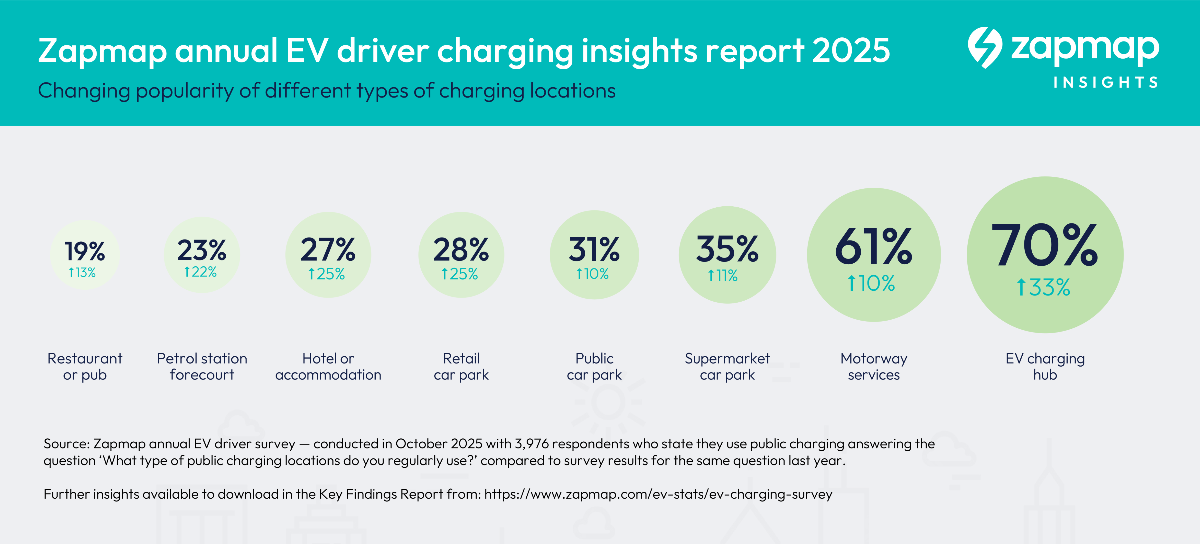

Within this category, Zapmap’s Annual EV Charging Survey shows that charging hubs have overtaken MSAs as the most popular place to charge, with 70% of drivers now using them. An additional 214 hubs have been added to the Zapmap database this year.

“We’ve seen a lot of progress in this area throughout 2025” comments Edwards, “with more focus on driver needs and innovations such as CPOs using solar power and battery technologies to lessen impact on the grid. A new £10 million fund allocated by Government to invest in solutions to enable chargers to run off-grid or reduce the size of grid connections is open to applications until end of March 2026 and has the potential to speed up and simplify roll-out both in congested, high-demand areas such as motorways, and also rural areas with limited grid infrastructure.”

LEVI funded projects finally hitting the streets

At the other end of the spectrum, on-street charging, aimed at providing people without access to off-street parking with as close an experience as possible to at-home charging, has also seen above average growth this year. In September, the first LEVI fund supported charge point, installed by char.gy in Brighton and Hove, went live on Zapmap. While the pipeline to delivery for these projects has been slower than anticipated, we’re now seeing a steady stream of announcements of contract awards from Cornwall to Redcar and from North Lincolnshire to Bolton, which will translate into thousands of additional charge points being activated throughout 2026. This will become particularly relevant as the number of drivers switching to electric grows, and with it the proportion of people who are totally reliant on public charging.

“We’re seeing continued efforts to ensure more equitable access to both home and public charging.” comments Edwards. “In November, the Government proposed further planning reforms to make it easier for renters and those without driveways to access cheaper home charging via gulley charging. While not a silver bullet, it could be a good way for households to benefit from the convenience of home charging as well as accessing broader carbon and cost savings via solar panels and battery technologies.”

Destination charging: the glue that holds it all together

This year, Zapmap joined the BVRLA for its Bon VoyCharge campaign, highlighting best practice and offering guidance for EV provision at locations where people typically stop for a while anyway: tourist attractions, hotels, leisure facilities, and other destinations that can sometimes be overlooked when it comes to EV infrastructure. There’s a growing recognition that EV charging at accommodation sites is increasingly expected and has the potential to provide competitive advantage, and indeed Zapmap stats show that this location class has seen nearly 30% growth this year. In rural areas, where there may not be sufficient major road infrastructure or through-traffic to support en-route charging, destination charging can play a critical role for residents and visitors alike, and for drivers with no near-home charging option, can make EV ownership more viable.

Supermarkets, another location type usually categorised under destination charging, with a typical 30 minute shop matching well with a typical 30 minute top-up, now represent approximately five percent of all charge points. Our analysis this year shows almost all major chains increasing charging provision, with some, such as Sainsbury’s (winner of this year’s Zapmap Best EV Charging Network: Medium rapid / ultra-rapid), Morrisons, via its partnership with MFG, and M&S focusing increasingly on rapid and ultra-rapid charging and others, such as Iceland, testing the waters of EV charging provision for the first time this year.

Increasing satisfaction with public charging

Zapmap’s Annual EV Driver Survey shows that satisfaction with the public charging infrastructure has grown this year to an average of 69/100 points (from 65 in 2024). While Public Charge Point Regulations (PCPR) reliability reports have not yet been shared publicly, survey participant ratings for reliability increased for most qualifying networks, suggesting that CPOs’ efforts in this area are yielding fruits.

In our network rankings, based on survey responses, the Tesla Public Supercharger network was awarded the title of ‘Best EV charging network 2025’ in the ‘Large rapid / ultra-rapid’ category, while ‘Best EV charging network 2025 in the ‘Medium rapid / ultra-rapid network’ was awarded to Sainsbury’s Smart Charge. Connected Kerb and RAW Charging shared the ‘Best EV charging network 2025 title in the ‘On-street / Destination network’ category.

Matt Lloyd, Head of CPO Networks at Zapmap comments:

“The Public Chargepoint Regulations as they relate to Open Data have allowed Zapmap to surface data into our app and products from CPOs that we have not previously worked with. As a result, we’re able to continue to lead the market with the most extensive data coverage for public networks, which in turn helps EV drivers find and pay for charging with confidence.”

The past twelve months have seen numerous partnerships between CPOs and landlords, with many network operators, such as Believ, GRIDSERVE, Osprey and Connected Kerb also securing funding to enable continued delivery of growth plans. According to Lloyd, 2026 may be the year when we begin to see consolidation in the market.

We’re also seeing CPOs moving focus from building the network to developing a profitable operation. For this understanding, patterns of utilisation are key, and Zapmap is well placed to help with this through our market leading data and deep understanding of the UK EV landscape. Our webinar on charge point utilisation earlier this year was a platform for critical discussion of this topic and can be viewed here.

Increased payment flexibility and rewarding loyalty

Over the course of 2025, Zapmap has grown its payment coverage from just over 20,000 devices across the UK to more than 55,000, and also added a charge card to supplement in-app payments. Our pay functionality now extends across more than 40 networks providing a combination of en route, destination and near home charging.

“In 2026 we’ll continue to extend this payment coverage across even more of the public infrastructure,” says Lloyd, “making the payment process as simple and flexible as possible for EV drivers and giving them a wider choice of payment options, through the Zapmap app or charge card. We’ll be working with charging networks to help drive repeat visits, rewarding loyalty and reinforcing the cost benefits of driving electric.”

The cost of driving electric: an ongoing debate

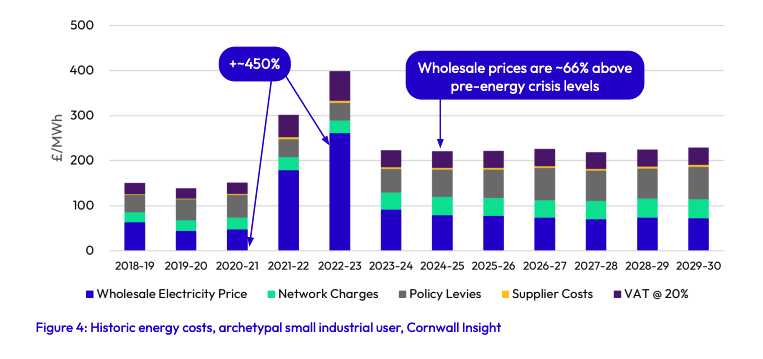

The cost of charging, although not the biggest factor in determining where EV drivers charge, continues to be flagged as a cause for concern and a potential source of hesitancy for those considering making the switch. Zapmap tracks the cost of charging, available via the Zapmap Price Index. Overall, public charging prices have come down slightly over the course of 2025 and it remains the case that those EV drivers who do the majority of their charging at home continue to be better off driving electric. However, there is scope for more to be done to improve the situation, and in September, Charge UK, the industry body for charge point operators, presented its ‘Delivering Affordable Charging for All’ report, which highlights ways to reduce the burden on CPOs in order to lower public charging costs.

Melanie Shufflebotham comments:

“Energy costs in the UK are higher than in the EU, with electricity pricing pegged to the price of gas, meaning that increasing levels of renewable energy do not translate into cheaper fuel prices. We were pleased to see full exemption on business rates for charging sites in the recent budget, alongside additional government investment and an extension of the EV Car Grant but, fundamentally, public charging costs are an area that continues to call out for attention.”

The November budget also saw the announcement of a 3p per mile tax for EV drivers, generating a huge volume of commentary and speculation on the potential impact on the industry.

“While it’s not unreasonable to expect EV drivers to contribute to the cost of the road network as the market matures, the timing of this levy is poor, coming just as momentum is building in the market.” Shufflebotham continues.

“It risks having a detrimental effect on driver confidence and impacting on the secondhand EV market in particular, which plays a crucial role in the transition to sustainable transport.”

In the New Year, Melanie Shufflebotham will be joining Glenn Lyons, Professor of Future Mobility at UWE Bristol, alongside a line-up of academics, policy-makers, consultants and industry players to discuss the topic: Will paying for road use prove electrifying? Details can be found here.

Ongoing efforts to tackle misinformation

Misinformation continues to be a challenge, and Zapmap is working with a number of industry peers to help ensure drivers have a clear and accurate understanding of the benefits of driving electric. In September we joined char.gy for a panel to discuss the influence that misinformation is having on electric vehicle adoption and the opportunity to reverse it through fact-based public education. The resulting report, ‘What Everyone Should Know About EVs’, demonstrates that exposure to simple, fact-based statements such as ‘EV batteries last 10–15 years’ led to a 12-point increase in willingness to consider an EV among long-term considerers.

We welcomed changes to rules around signage for larger charging hubs near major A roads in July, not only to support existing EV drivers, but because visibility of charging options helps address nervousness and confusion around the ability to charge for those who have yet to make the switch. Signage is restricted to hubs that offer food and parking, and we would like to see this softened in future for greater impact. With an ongoing focus on charging costs and pricing transparency, we may also see moves towards pricing totems such as those seen at petrol forecourts, although we see that an app with real-time digital updates will remain the key way to understand and compare prices.

Supporting the evolving community of EV drivers

Readers who have followed Zapmap since the earliest days of the EV transition will know that the driver community has always been at the heart of what we do. Over the course of 2025, we’ve seen the market become more accessible, with a broader range of cheaper models and the range of second hand EVs available better suited to the needs of the average driver.

There is however, a need to better support drivers buying used vehicles, observes Ed Walsh, Head of Product at Zapmap:

“We need to ensure that policy and industry are supportive of those on lower incomes moving to EV — and that people get great support whether they buy through a dealer or not. There will be a huge number of second hand EVs moving on into new hands over the coming year, and their successful uptake is vital for making the whole market more accessible.”

Through 2025, Walsh has led two great strategic partnerships at Zapmap, extending Hive’s proposition to help its customers access charging away from home, and also starting to connect The AA’s driver community to public charging. These strategic partnerships are vital to ensure we meet users where they are, bringing together holistic propositions that position EVs as great options within wider value offerings.

The ongoing focus on charging costs is not simply about the price itself; for Walsh, the priority is clear pricing communication and ease of pricing comparisons. As Zapmap moves into 2026, his team’s focus will be on ensuring that people are never surprised by the price of charging and can readily find the most suitable charging for them, based on their needs.

“Our service will shift to be a more active companion for drivers — doing more to help them get a consistently great charge, whatever their needs, whenever they want to charge,” says Walsh.

“ Every month more options come onto the market: our goal is to ensure drivers can more easily see the right option, and see the changing options in their area.”

A maturing, more joined-up ecosystem

The scale of investment in electricity networks over the coming years presents the UK with a huge growth opportunity, generating jobs, income and innovation. We’re already a leading EV country — of the 10 largest car markets, the UK is second only to China on EV market share as a percentage of new car registrations — and 2026 will be a pivotal year in ensuring that we continue to lead the way.

Richard Bourne, CEO of Zapmap explains what this means for the company:

“We’ve always fostered close working relationships with key organisations across the sector to support the shift to EVs, and this year is no exception, as we’ve worked alongside EVA England, Cenex, Charge UK, Electric Vehicles UK, Autotrader, BVRLA, GreenFleet and the REA, among others, to foster greater understanding and share our learnings.

“The year ahead will be about continuing to work together as an industry to move further and faster, and beyond that, recognising and capitalising on EVs’ position at the heart of the wider sustainable energy ecosystem, delivering greater benefits for households, industry and the economy alike.”